The insurance claims process has traditionally been a complex and resource-intensive operation, plagued by manual interventions, lengthy processing times, and significant operational costs. In recent years, artificial intelligence has emerged as a transformative force, fundamentally reshaping how insurance companies approach claims management and delivering unprecedented value across multiple dimensions of their operations.

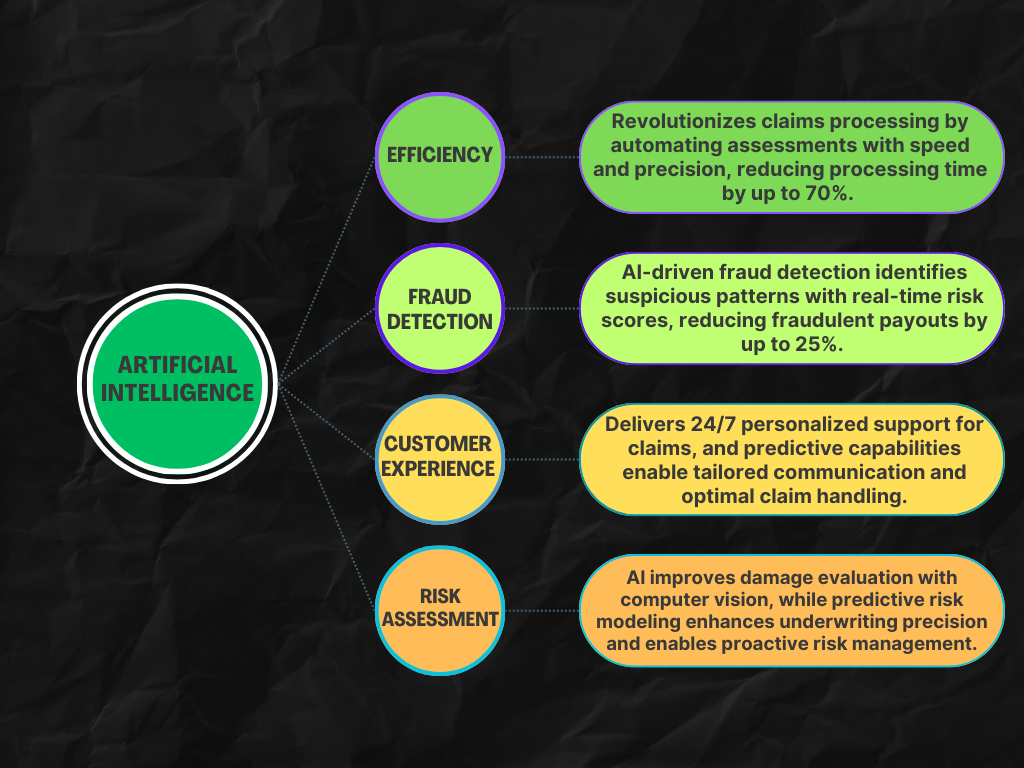

Revolutionizing Claim Processing Efficiency

Modern AI technologies are dramatically accelerating and improving the claims processing landscape. By implementing advanced machine learning algorithms, insurance companies can automatically assess claim submissions with remarkable speed and precision. These intelligent systems instantly analyze uploaded documents and images, extracting critical information with near-perfect accuracy. The sophisticated technology can categorize claims based on their complexity, risk profile, and unique characteristics, automatically routing them to the most appropriate handlers or departments.

The impact on operational efficiency is profound. Traditional claims processing often requires hours or even days of manual review, but AI-powered systems can reduce processing time by up to 70%. This dramatic reduction directly translates into lower operational costs and significantly faster claim resolutions, ultimately improving internal productivity and customer satisfaction.

Advanced Fraud Detection and Prevention

One of the most compelling applications of AI in claims management is its ability to detect and prevent fraudulent activities. Utilizing complex predictive analytics, AI systems can analyze vast amounts of historical claim data to identify suspicious patterns and anomalies that might escape human detection. These intelligent models generate real-time fraud risk scores, allowing insurers to flag high-risk claims for detailed investigation before potential payouts.

What makes these AI-driven fraud detection systems truly remarkable is their capacity for continuous learning. Unlike static rule-based systems, these machine learning models adapt and evolve, incorporating the latest investigation outcomes and refining their risk assessment algorithms. This dynamic approach enables insurance companies to stay ahead of increasingly sophisticated fraudulent tactics, potentially saving millions annually by reducing fraudulent claim payouts by 15-25%.

Enhancing Customer Experience Through AI

The customer experience is another critical area where AI is driving transformative change. AI-powered chatbots and virtual assistants now provide 24/7 claim status updates, offering instant responses to basic queries and personalized guidance throughout the claim submission process. These intelligent communication tools can support multiple languages and adapt their communication style to individual customer preferences, creating a more engaging and supportive claims experience.

By leveraging AI to understand and anticipate customer needs, insurance companies can offer more personalized claim handling. The technology can predict potential claim complexities, recommend optimal resolution paths, and tailor communication strategies to individual customer profiles. This level of personalization not only improves customer satisfaction but also increases retention rates and reduces potential churn.

Risk Assessment

AI technologies are also transforming damage evaluation and risk assessment. Computer vision and machine learning algorithms can now analyze accident damage images with extraordinary accuracy, providing instant estimations of repair costs and recommending the most appropriate repair or replacement strategies. This technological capability dramatically reduces claim processing times and improves the accuracy of initial damage assessments.

Moreover, predictive risk modeling allows insurers to assess potential risks before they manifest. By analyzing complex datasets and identifying subtle risk patterns, AI enables more precise underwriting strategies and helps develop proactive prevention recommendations. This shift from reactive to predictive risk management represents a fundamental transformation in how insurance companies approach their core business model.

Navigating Implementation Challenges

Despite the tremendous potential, implementing AI in claims management is not without challenges. Insurance companies must be prepared to make significant technology investments, recruit skilled AI and data science professionals, and carefully integrate these advanced systems with legacy infrastructure. Data privacy, security, and regulatory compliance remain critical considerations that demand rigorous attention and sophisticated technological safeguards.

Conclusion: The Intelligent Future of Claims Management

Artificial intelligence is more than a technological upgrade—it represents a strategic revolution in claims management. By embracing AI-driven solutions, insurance companies can achieve substantial cost reductions, dramatically enhance operational efficiency, deliver superior customer experiences, and establish a compelling competitive advantage in an increasingly digital marketplace.

As AI technologies evolve, we can anticipate more sophisticated predictive models, enhanced real-time processing capabilities, and increasingly seamless integrations across insurance value chains. The future of claims management is undeniably intelligent, predictive, and customer-centric.

Reference

- McKinsey & Company. (2023). “AI in Insurance: Improving Processes and Customer Experience”

- Gartner Research Report. (2022). “Artificial Intelligence Technologies in Insurance Claims Management”

- Deloitte Insurance Technology Insights. (2023). “Digital Transformation in Claims Processing”

- Journal of Insurance Technology. (2022). “Machine Learning Applications in Claims Fraud Detection”

- IEEE Transactions on Artificial Intelligence. (2023). “Computer Vision in Damage Assessment”

- Accenture Insurance Technology Research. (2023). “AI-Powered Claims Management: Transformative Strategies”

- PwC Digital Insurance Report. (2022). “The Future of Claims Management”