Property and Casualty (P&C) insurance is a critical segment of the insurance industry, providing coverage for assets like homes, cars, and businesses and liability protection. However, this sector faces challenges that threaten profitability, sustainability, and customer satisfaction. Factors such as shifting market conditions, evolving customer expectations, and technological disruptions create complex scenarios for insurers. Addressing these challenges requires a blend of innovative strategies and the adoption of emerging technologies to stay competitive.

This article will delve into some of the most significant challenges faced by P&C insurers today, including regulatory changes, data management complexities, and the need for operational efficiency. We’ll also explore practical solutions such as digital transformation, advanced data analytics, and improved customer engagement practices that can help insurers overcome these hurdles.

1. Regulatory Compliance and Changing Legislation

Challenges:

Regulatory compliance is a top concern for P&C insurers, as governments frequently update policies related to data privacy, reporting standards, and consumer protection. The regulatory landscape is not only complex but also varies widely across regions. Insurers operating in multiple jurisdictions must keep up with changing regulations, leading to increased compliance costs and operational inefficiencies.

Moreover, the rising focus on Environmental, Social, and Governance (ESG) criteria means that P&C insurers are under pressure to adopt sustainable practices. This trend influences underwriting standards, risk assessment, and investment decisions.

Solutions:

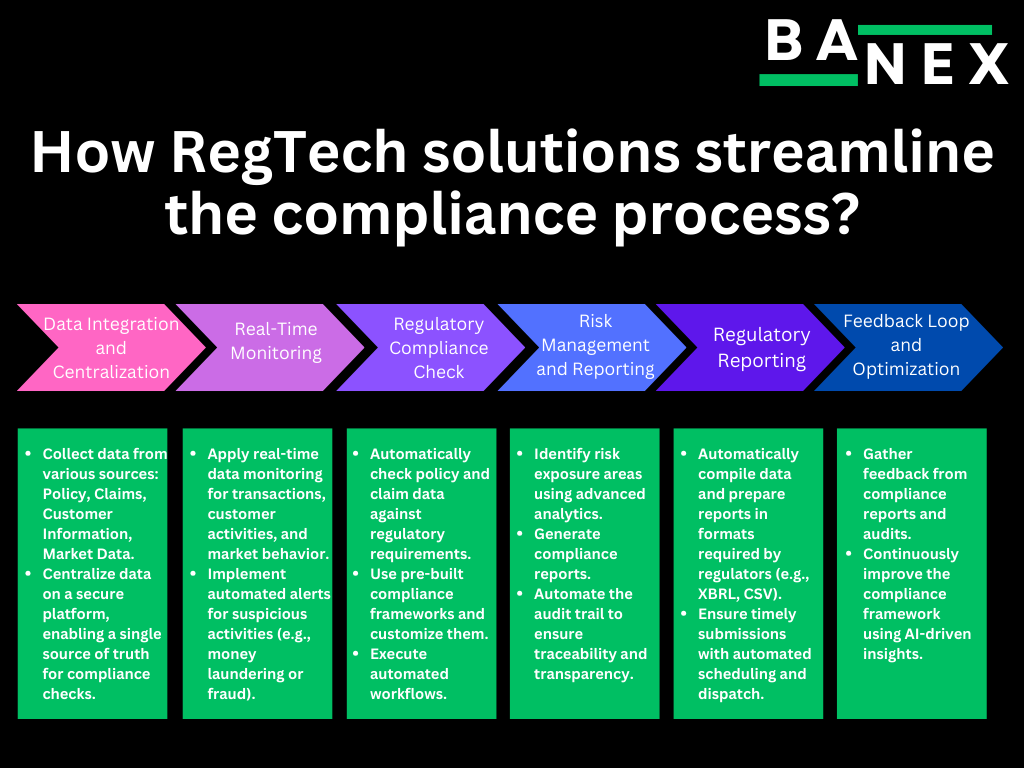

- Automated Compliance Tools: Implementing automated compliance solutions can streamline the process of adhering to regulatory changes, reducing human error and ensuring faster updates.

- RegTech Adoption: Regulatory technology (RegTech) tools offer real-time monitoring and compliance checks, which help insurers stay ahead of changes.

- Collaboration with Legal Experts: Regular collaboration with legal experts ensures proactive compliance management and helps mitigate non-compliance risks.

2. Data Management and Cybersecurity Risks

Challenges:

P&C insurers deal with vast amounts of sensitive customer data, making data management a crucial aspect of operations. However, managing this data is becoming increasingly complex due to multiple sources, formats, and data quality issues. Moreover, as the industry embraces digital channels, cybersecurity risks become more prominent.

Data breaches can lead to significant financial losses, reputational damage, and regulatory penalties. Cyberattacks targeting sensitive personal and financial information can undermine customer trust and disrupt business continuity.

Solutions:

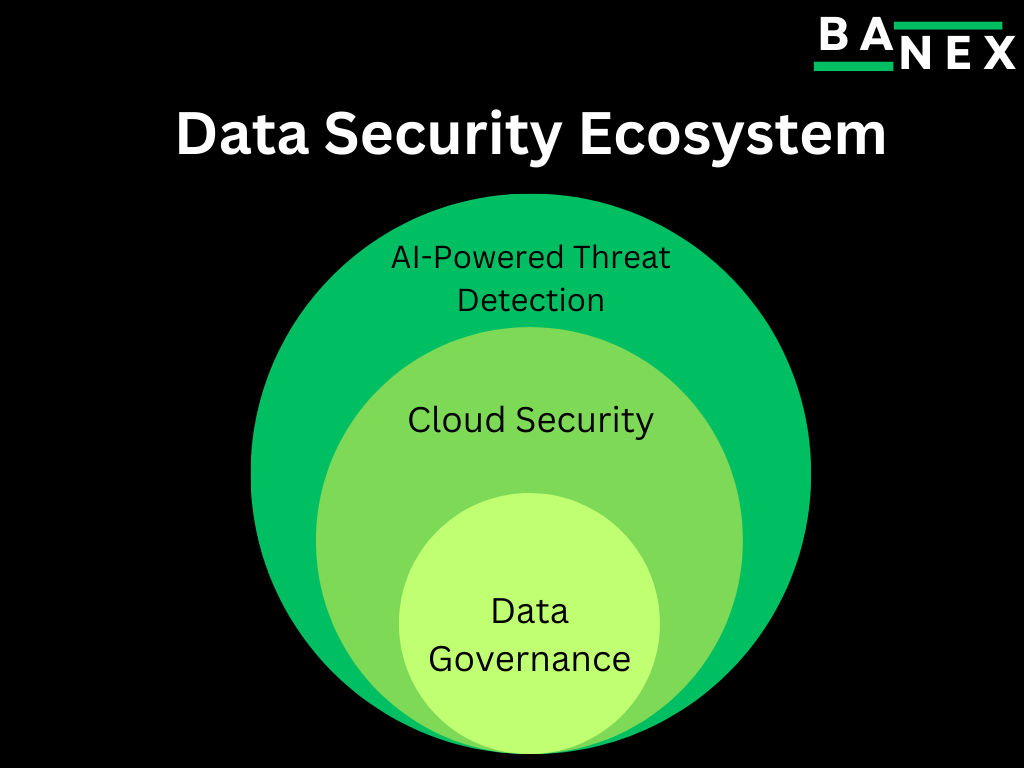

- Enhanced Data Governance Frameworks: Establishing robust frameworks ensures data accuracy, consistency, and integrity across the organization.

- Adopting Cloud Security Solutions: Cloud-based platforms with built-in security features can offer better protection against data breaches and unauthorized access.

- AI-Powered Threat Detection: Implementing artificial intelligence (AI) and machine learning (ML) algorithms can help detect anomalies and potential cyber threats in real-time.

3. Evolving Customer Expectations

Challenges:

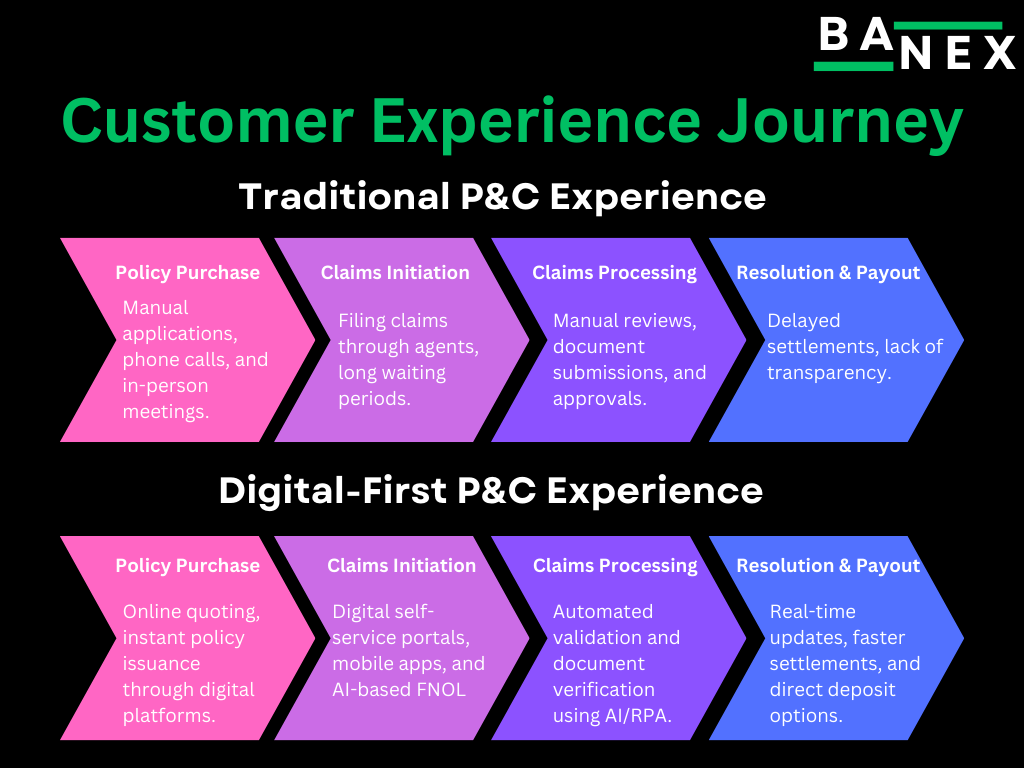

Today’s customers demand personalized, convenient, and seamless experiences. However, traditional P&C insurance models are often slow to adapt to these expectations. Customers expect quick policy issuance, instant claim settlements, and 24/7 support, making it difficult for insurers who rely on legacy systems to keep up.

Additionally, younger customers are more likely to compare multiple providers online and prioritize cost-effective, customizable policies. This trend requires insurers to invest in digital platforms and customer engagement tools to enhance user experiences.

Solutions:

- Digital Transformation Initiatives: Investing in digital platforms, mobile apps, and online portals can significantly improve customer experience by enabling self-service options.

- AI and Chatbots for Customer Support: AI-driven chatbots can handle customer queries, provide instant policy information, and assist in filing claims, improving responsiveness.

- Data-Driven Personalization: Utilizing customer data analytics can help insurers create tailored offerings and proactive engagement strategies that meet individual needs.

4. Operational Inefficiencies and Cost Management

Challenges:

High operational costs are a persistent issue for P&C insurers, driven by factors such as outdated technology, manual processes, and fragmented systems. Claims processing, underwriting, and policy management often involve redundant tasks that result in delays, errors, and increased costs.

Additionally, competitive pressures necessitate cost-effective operations to maintain profitability. However, Traditional cost-cutting measures may not be enough to achieve the desired efficiency level without compromising service quality.

Solutions:

- Process Automation: Implementing robotic process automation (RPA) can eliminate repetitive manual tasks, reducing processing times and human errors.

- Integrated IT Systems: Transitioning to integrated IT systems can streamline processes, enhance communication, and ensure seamless data sharing between departments.

- Cost Optimization Strategies: Leveraging advanced analytics to identify areas of waste and inefficiencies can lead to better resource allocation and cost savings.

5. Technological Disruptions and the Need for Innovation

Challenges:

The insurance industry is transforming rapidly due to technological advancements such as AI, blockchain, and the Internet of Things (IoT). These technologies can enhance operations, risk assessment, and customer experiences. However, they also pose challenges regarding integration, investment, and talent acquisition.

Furthermore, InsurTech startups are entering the market with innovative business models and agile technology platforms, intensifying competition for traditional insurers.

Solutions:

- Strategic Partnerships with InsurTechs: Collaborating with InsurTech firms can help traditional insurers access cutting-edge technologies without significant in-house investments.

- Investment in Research and Development (R&D): Investing in R&D ensures that insurers stay ahead of technology trends and develop innovative products and services.

- Creating Innovation Hubs: Establishing dedicated innovation hubs allows insurers to experiment with new ideas, test technology solutions, and accelerate digital transformation.

Conclusion

P&C insurers are at a crossroads, facing numerous challenges that require strategic and technological adaptations. Insurers can navigate these challenges by leveraging advanced technologies, refining data management practices, and fostering customer-centric approaches. The adoption of automated compliance tools, AI-driven personalization, and process automation will enable insurers to enhance operational efficiency and deliver superior customer experiences.

In conclusion, the P&C insurance industry must embrace change and invest in innovative solutions to maintain relevance and competitiveness in an ever-evolving landscape. With the right strategies in place, insurers can turn these challenges into opportunities for growth and improved service delivery.